FNMA has issued 5 Selling Policy updates, signifying a pivotal moment in mortgage lending. Included in these updates, FNMA has clarified the impact of their NAR settlement on IPC caps. If a buyer’s agent commission continues to be a “common and customary” seller cost, it is not counted toward the Interested Party Contribution maximum (between 2% – 9% of the property value). The standard of “common and customary” has not been formalized and is measured by regional practice. As a recap, under the new system that NAR agreed to in settling the suit, when a home hits the market, listing agents will no longer specify how much the buyer’s agent will be paid. Instead, that fee will be negotiated separately between the buyer and the buyer’s agent. We have included a matrix of the current FNMA IPC maximums below, as well as FHLMC’s matrix for reference. Currently, there is no determination in how the Department of Veterans Affairs will handle potential changes to buyer real estate commissions. Moreover, there is still potential for changes to the FHFA rule that prevents buyers from rolling the listing commission into mortgages. Stay tuned for more updates. Subscribe to our Weekly Market Commentary for more.

Updated IPC Maximums

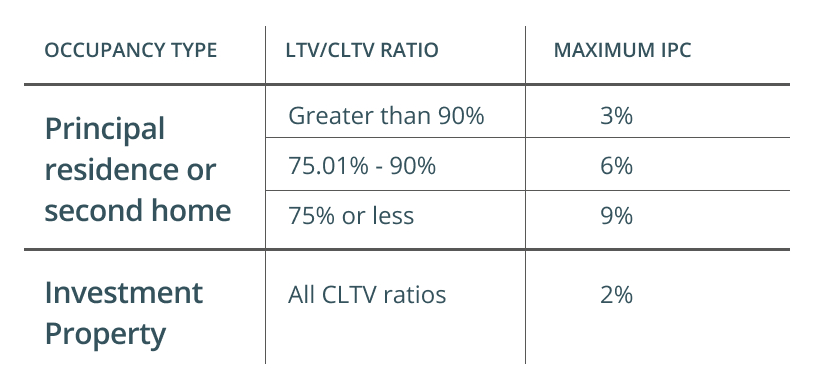

Maximum Interested Party Contributions for FNMA loans:

Maximum Interested Party Contributions for FHLMC Loans:

Link to full Selling Policy Updates here.