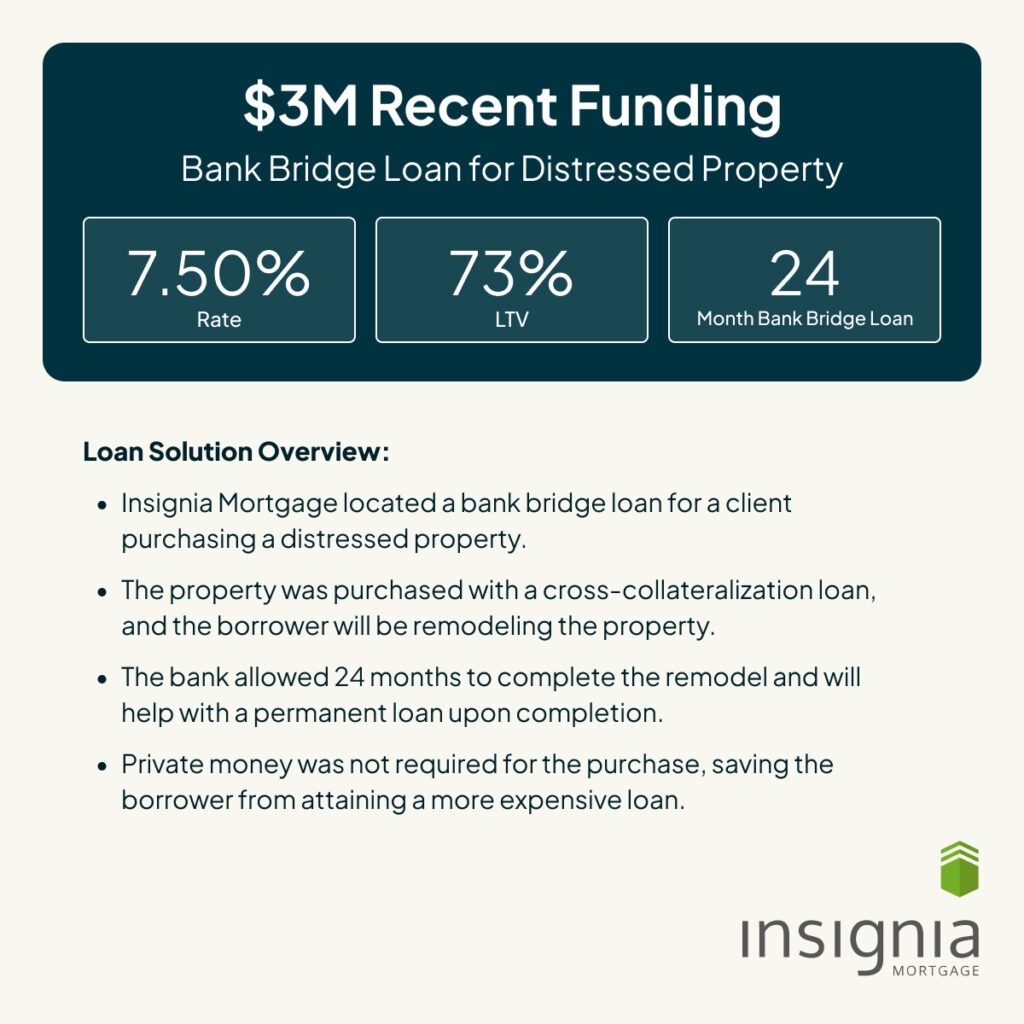

Insignia Mortgage recently closed a bank bridge loan for a distressed property for $3 million. This case study showcases Insignia’s unique ability to get truly complex loans funded.

In this scenario, the borrower approached Insignia Mortgage for funding to purchase a distressed property. Insignia Mortgage was able to locate a bank bridge loan for the client. The property was purchased with a cross-collateralization loan, and the borrower will be remodeling the property to make it habitable. The bank provided the borrower 24 months to complete the remodel and will help with the refinance into a permanent loan upon completion. This lender allowed the borrower not to have to use private money for the purchase, saving the borrower from having to attain a more expensive loan. The loan closed in under 3 weeks with all of the moving pieces.

At Insignia Mortgage, we understand that what works for one client does not always work for everyone. Especially when your financial picture doesn’t adhere to the strict model that many conforming lenders demand. Connect with us to learn more about our non-QM lending solutions.