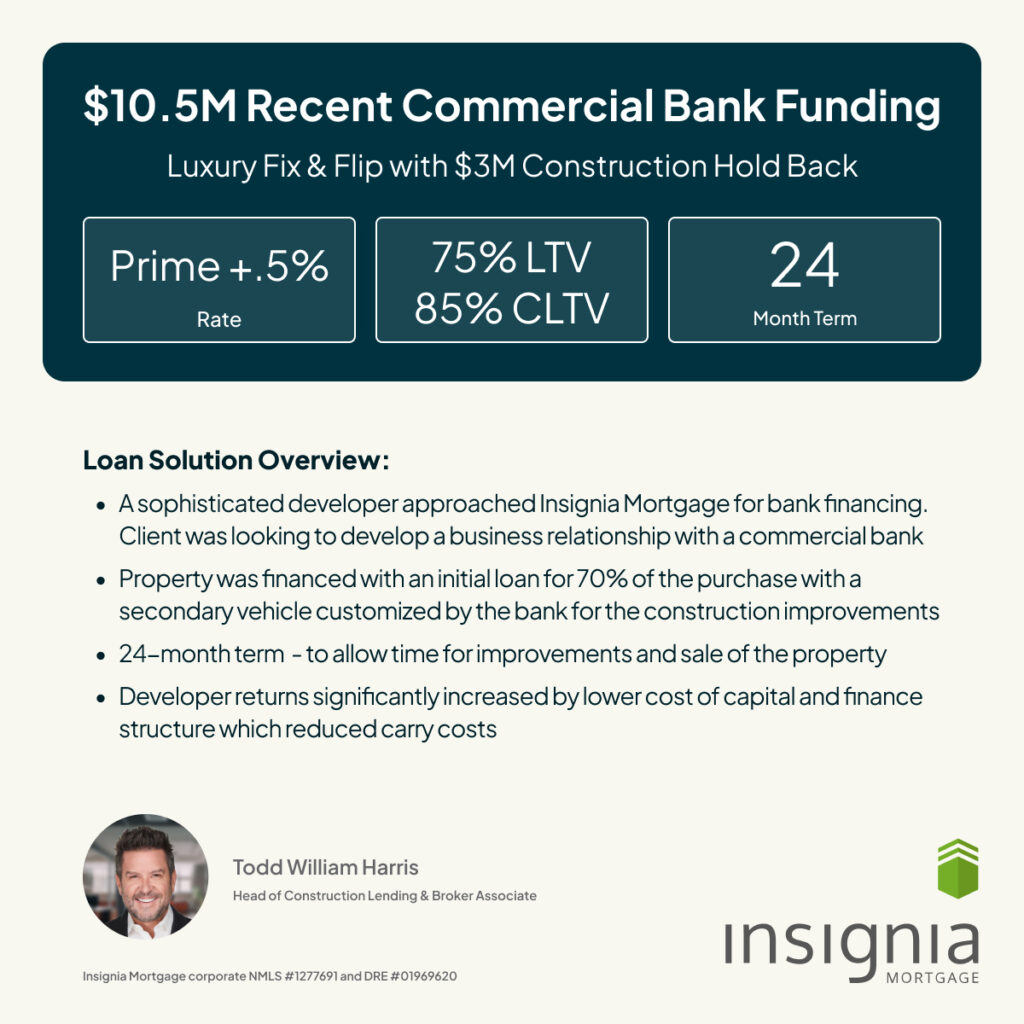

Insignia Mortgage recently closed $10.5M Commercial Bank Funding. This case study showcases Insignia’s unique ability to get truly complex loans funded.

In this scenario, a sophisticated developer approached Insignia Mortgage for bank financing. The developer did not want funding from a private money source and was looking to develop a business relationship with a commercial bank. The property was financed with an initial loan for 70% of the purchase with a secondary vehicle customized by the bank for the construction improvements. A 24-month term was offered to allow ample time for improvements and the sale of the property. The developer returns significantly increased by lower cost of capital and optimized finance structure which lowered carry costs. Exceptional work by our Head of Construction Lending & Broker Associate, Todd William Harris.

At Insignia Mortgage, we understand that what works for one client does not always work for everyone. Especially when your financial picture doesn’t adhere to the strict model that many conforming lenders demand. Connect with us to learn more about our non-QM lending solutions.